According to the latest data released by the Department for Promotion of Industry and Internal Trade (DPIIT), foreign direct investment (FDI) into India witnessed a decline of 22% to reach USD 46 billion during the fiscal year 2022-23. This decrease in FDI inflows can be attributed to lower investments in the computer hardware and software sectors, as well as the automobile industry. In comparison, the country received FDI inflows of USD 58.77 billion in the previous fiscal year of 2021-22.

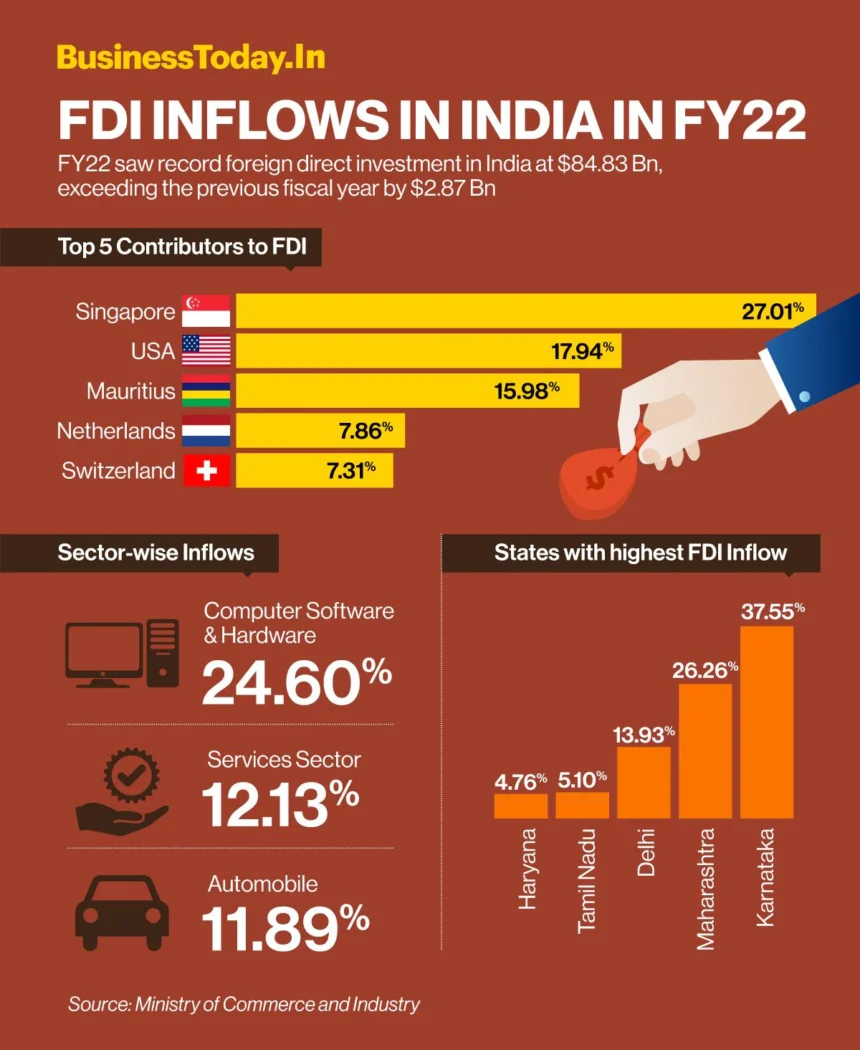

The total FDI inflows, which include equity inflows, reinvested earnings, and other capital, registered a 16% decline to USD 70.97 billion during the last fiscal year, as compared to USD 84.83 billion recorded in 2021-22.

The decline in FDI inflows is concerning for India, as it suggests a loss of investor confidence in key sectors of the economy. The computer hardware and software industry, which witnessed a significant drop in FDI, is a crucial sector for India’s digital transformation and software exports. The decrease in investments could potentially hinder the growth and development of this sector, affecting job creation and technological advancements.

Similarly, the decline in FDI inflows in the automobile industry raises concerns for the country’s manufacturing sector. India is known for its robust automobile manufacturing capabilities and has attracted numerous global automakers over the years. However, the decrease in FDI indicates a potential slowdown in the sector, which could impact production, employment, and overall economic growth.

The COVID-19 pandemic has undoubtedly played a significant role in the decline of FDI inflows. The global economy has been grappling with the consequences of the pandemic, including supply chain disruptions, reduced consumer demand, and uncertainty in financial markets. These factors have made investors cautious and hesitant to make substantial investments, leading to a decline in FDI inflows globally.

India, like many other countries, has also faced challenges in managing the pandemic, including periodic lockdowns and disruptions to economic activities. These factors have had an adverse impact on investor sentiment and contributed to the decline in FDI inflows.

To counter the decline in FDI, the Indian government needs to focus on improving the investment climate and addressing concerns that may deter foreign investors. This could include policy reforms to enhance ease of doing business, simplifying regulatory processes, ensuring a stable tax regime, and investing in infrastructure development. By creating an investor-friendly environment, India can regain investor confidence and attract higher levels of FDI in the future.

Furthermore, promoting sector-specific incentives and reforms can help attract investments in critical areas such as computer hardware, software, and the automobile industry. These sectors are crucial for India’s economic growth and should be given priority in terms of policy interventions and support.

It is worth noting that FDI is a vital source of capital inflows for developing countries like India. It not only brings financial resources but also facilitates technology transfer, knowledge sharing, and job creation. Therefore, it is imperative for India to address the challenges and create an environment conducive to foreign investment to ensure sustained economic growth and development.

The decline in FDI inflows into India in the fiscal year 2022-23, particularly in the computer hardware, software, and automobile industry, is a cause for concern. The COVID-19 pandemic and its associated challenges have played a significant role in dampening investor sentiment globally. To reverse this trend, the Indian government must focus on improving the investment climate, implementing sector-specific reforms, and creating an investor-friendly environment.