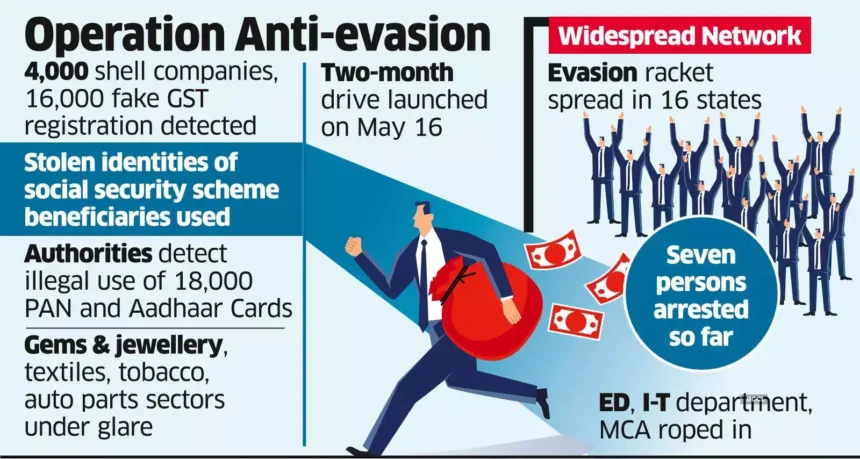

In a significant development, authorities have discovered a staggering case of Goods and Services Tax (GST) evasion amounting to more than Rs 8,100 crore. The evasion scheme was orchestrated through a network of 4,909 bogus business establishments operating across various parts of the country. The revelation was made by a tax official from Madhya Pradesh, highlighting the magnitude of the offense.

Lokesh Kumar Jatav, the Commercial Tax Commissioner of Madhya Pradesh, revealed that the state’s GST Department initially stumbled upon clues of this large-scale tax evasion during a comprehensive investigation into the e-way bills of an establishment in Indore. Subsequent detailed analysis and scrutiny of the collected data exposed a total of 4,909 suspicious business establishments operating nationwide.

Delving further into the findings, it was discovered that the highest concentration of these fraudulent establishments was in Delhi, with a staggering 1,888 cases. Uttar Pradesh followed closely with 831 establishments, while Haryana accounted for 474. Tamil Nadu, Maharashtra, Telangana, and Madhya Pradesh itself were also implicated, with 210, 201, 167, and 139 bogus businesses respectively.

The magnitude of this tax evasion scheme is deeply troubling for the authorities, as it involves a substantial amount of revenue that has been unlawfully evaded. GST, which is a comprehensive indirect tax levied on the supply of goods and services across India, serves as a significant source of government revenue. Detecting and preventing evasion is crucial to maintaining a fair and robust taxation system.

The intricate nature of the scheme is evident from the large number of establishments involved and their spread across different states. This suggests the existence of an organized network of individuals operating in collusion to exploit loopholes in the GST system. These bogus businesses are believed to have engaged in fraudulent activities, such as issuing fake invoices and misrepresenting their transactions, to evade GST obligations.

The authorities are now set to launch a thorough investigation into these suspicious establishments to uncover the modus operandi behind their activities. Such an investigation would likely involve scrutinizing financial records, conducting interviews, and gathering evidence to build a strong case against the perpetrators. The objective is not only to bring the evaders to justice but also to send a strong message that tax evasion will not be tolerated.

The detection of such a significant evasion scheme underscores the importance of robust compliance measures and effective enforcement mechanisms to ensure the integrity of the tax system. It highlights the need for enhanced coordination and information sharing among different tax authorities across states to identify and address such illicit practices promptly.

The government, in its efforts to combat tax evasion, has been deploying advanced technological tools and data analytics to strengthen tax administration and plug loopholes. It is imperative to continually update and refine these tools to stay one step ahead of those attempting to circumvent the system.

Furthermore, awareness campaigns and educational initiatives can play a vital role in fostering a culture of tax compliance among businesses and individuals. By promoting transparency, accountability, and a sense of civic duty, these efforts can contribute to reducing the prevalence of tax evasion and ensuring a fair and inclusive tax regime.

The detection of GST evasion amounting to over Rs 8,100 crore through 4,909 bogus business establishments is a stark reminder of the challenges posed by tax evasion. The authorities must now take swift and decisive action to investigate and prosecute those responsible, while simultaneously implementing measures to strengthen the tax system and prevent such occurrences in the future.