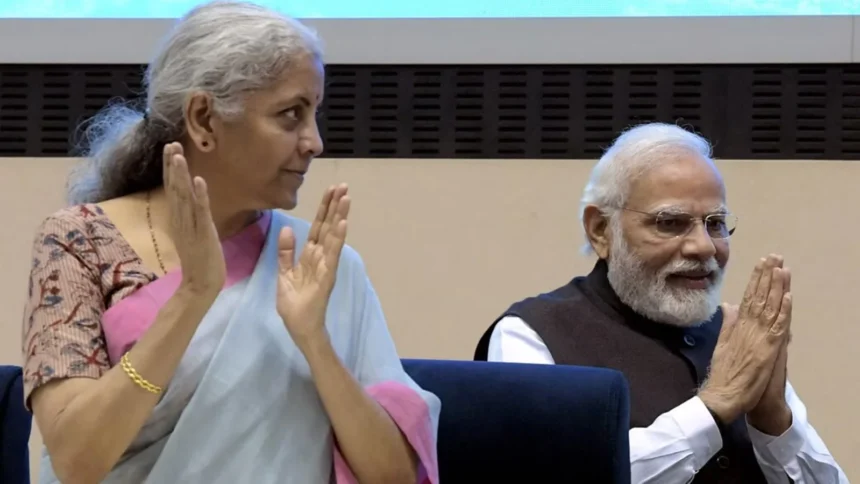

Narendra Modi’s tenure as the Prime Minister of India has been marked by a series of bold economic reforms and policies that have reshaped the country’s economic landscape. Under his leadership, India has witnessed a wave of transformative initiatives, collectively known as “Modinomics,” aimed at attracting investment, promoting entrepreneurship, and fostering sustained economic growth. This article explores the impact of these policies on India’s economy, highlighting key initiatives such as Make in India, Digital India, and the Goods and Services Tax (GST).

Make in India, launched in 2014, is an ambitious program designed to transform India into a global manufacturing hub. The initiative aims to encourage both domestic and foreign companies to invest in manufacturing sectors by providing incentives, reducing bureaucratic hurdles, and improving the ease of doing business. As a result, India has witnessed a surge in foreign direct investment (FDI) and a substantial boost to its manufacturing sector. The program has not only created millions of jobs but has also spurred innovation and technology transfer, further enhancing the country’s economic capabilities.

Digital India, another cornerstone of Modinomics, seeks to harness the power of technology and connectivity to empower citizens and drive inclusive growth. The initiative aims to bridge the digital divide by providing affordable internet access, promoting digital literacy, and encouraging the adoption of digital services across various sectors. Through the widespread use of technology, India has witnessed a digital revolution, transforming the way people access information, conduct business, and engage with the government. Digital transactions have surged, financial inclusion has increased, and e-governance has become more efficient, resulting in a more transparent and accessible economy.

The introduction of the Goods and Services Tax (GST) in 2017 was a watershed moment in India’s tax regime. The GST replaced a complex web of indirect taxes, streamlining the tax structure and creating a unified national market. This historic tax reform has simplified the tax compliance process, eliminated cascading taxes, and reduced transaction costs for businesses. By fostering a common market, the GST has enhanced inter-state trade and integration, promoting economic efficiency and competitiveness. While the initial implementation faced some challenges, the GST has gradually stabilized, contributing to increased tax revenues and formalizing the economy.

In addition to these flagship initiatives, Modinomics has focused on infrastructure development, financial inclusion, and skill development. Massive investments have been made in building roads, railways, airports, and other critical infrastructure, laying the foundation for sustainable economic growth. Financial inclusion programs such as Jan Dhan Yojana have brought millions of previously unbanked individuals into the formal financial system, promoting savings, credit access, and social security. Skill India has aimed to enhance employability and bridge the skills gap, equipping the workforce with the necessary skills to thrive in a rapidly evolving economy.

The impact of Modinomics on India’s economy has been substantial. India’s GDP growth has been consistently higher than the global average, and it has emerged as one of the world’s fastest-growing major economies. FDI inflows have surged, reaching record levels, indicating renewed investor confidence in India’s economic potential. The manufacturing sector has witnessed significant growth, and India’s digital economy is thriving, creating new opportunities and transforming traditional industries. The tax reforms have increased the tax base, boosted compliance, and formalized the economy.

However, challenges remain. The COVID-19 pandemic has posed unprecedented economic challenges, requiring swift policy responses to mitigate the impact. Additionally, there is a need to address issues such as job creation, agrarian distress, and income inequality to ensure inclusive growth for all segments of society.