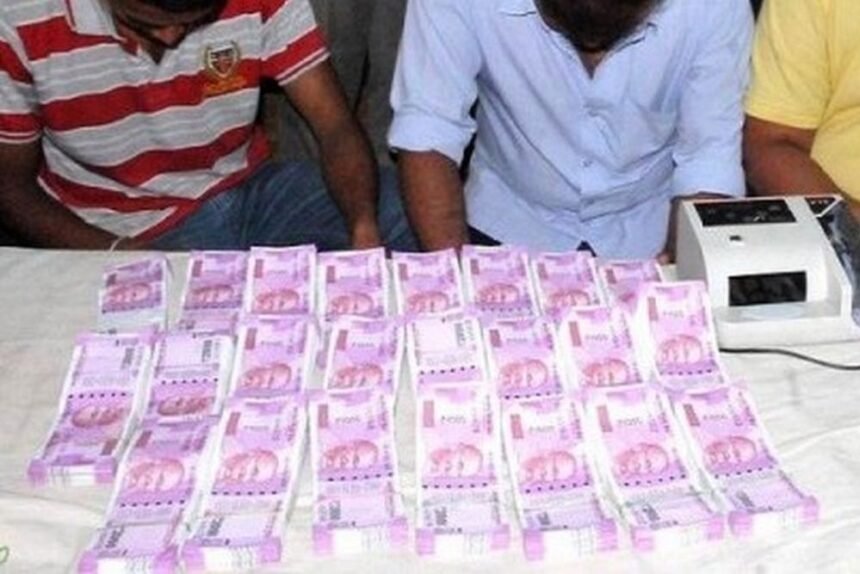

Former finance secretary Subhash Chandra Garg has stated that the withdrawal of Rs 2,000 currency notes is a ‘non-event’ and will have no significant impact on the economy or monetary policy. Garg made these remarks on Saturday, emphasizing that the higher denomination currency note was introduced for ‘accidental reasons’ during the demonetization exercise in 2016 to address a temporary currency shortage.

Garg further highlighted that with the rapid growth of digital payments in recent years, the withdrawal of Rs 2,000 currency notes, which will be replaced by other denominations, would not affect the total currency in circulation. As a result, he believes it will have no effect on monetary policy.

The decision to withdraw the Rs 2,000 currency notes comes as part of the government’s ongoing efforts to promote digital transactions and reduce the use of cash in the economy. The Reserve Bank of India (RBI) had initially introduced the Rs 2,000 denomination note to ease the process of remonetization after the demonetization exercise, which aimed to curb black money and counterfeit currency.

Garg’s assertion that the withdrawal of the Rs 2,000 notes will have no significant impact is rooted in the observation that the use of digital payment methods has seen substantial growth over the past five to six years. The convenience and accessibility of digital payment platforms have gained popularity among the Indian population, resulting in a gradual shift away from cash transactions.

According to Garg, the replacement of the Rs 2,000 notes with other denominations will not affect the overall currency in circulation, meaning that the withdrawal will not impact monetary policy. The total amount of currency available for transactions will remain unaffected as the supply of lower denomination notes increases to compensate for the removal of the higher denomination.

It is important to note that Garg’s perspective reflects his opinion as a former finance secretary and may not necessarily align with the views of all experts in the field. While he acknowledges the increasing adoption of digital payments, other economists and financial analysts may hold different perspectives on the potential consequences of withdrawing the Rs 2,000 currency notes.

The government’s decision to withdraw the higher denomination notes aligns with its broader agenda of fostering a digital economy and reducing the reliance on cash. By promoting digital transactions, the government aims to enhance transparency, combat corruption, and facilitate financial inclusion for all segments of society.

As the transition towards a digital economy gains momentum, the impact of withdrawing the Rs 2,000 currency notes remains to be seen. The success of this measure will depend on various factors, including the availability and acceptance of alternative payment methods, the accessibility of banking services, and the level of public awareness and readiness for digital transactions.

While Garg’s assertion of the withdrawal being a ‘non-event’ implies minimal disruption, it is essential for policymakers to closely monitor the situation and assess its implications on the economy and monetary policy. As the digital revolution continues to reshape financial landscapes worldwide, India’s journey towards a cashless economy is likely to be closely watched by experts and stakeholders alike.