The Reserve Bank of India (RBI) and the Central Bank of the United Arab Emirates (CBUAE) have recently signed two significant agreements in Abu Dhabi. These agreements aim to establish a framework that promotes cross-border transactions in local currencies and facilitates the interlinking of payment and messaging systems between the two countries.

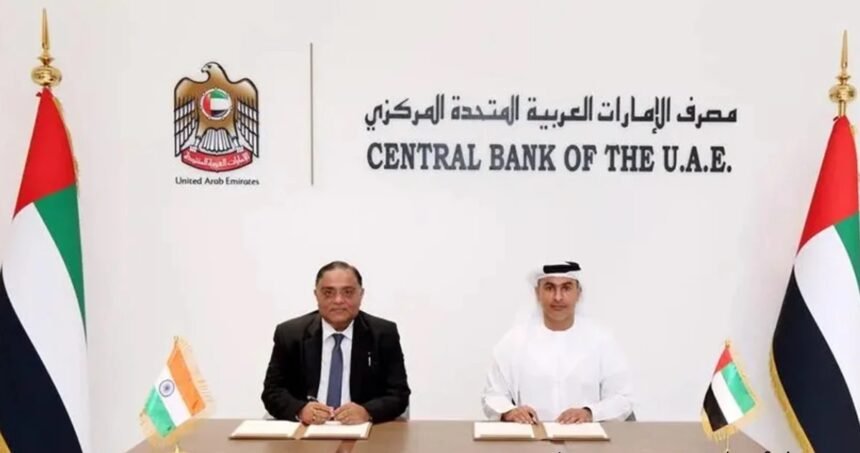

The exchange of agreements took place in the presence of Indian Prime Minister Narendra Modi and Sheikh Mohamed Bin Zayed Al Nahyan, the President of the UAE. The Reserve Bank highlighted that these memorandum of agreements (MoUs) are a significant step toward strengthening economic ties and enhancing financial cooperation between India and the UAE.

One of the MoUs focuses on establishing a framework to promote the use of local currencies, namely the Indian rupee (INR) and the UAE dirham (AED), for cross-border transactions. By facilitating the use of local currencies, the aim is to reduce reliance on international currencies and enhance trade and investment between the two nations. This move is expected to boost bilateral economic cooperation and create a more favorable environment for businesses and individuals engaged in cross-border trade.

The second MoU pertains to cooperation for interlinking the payment and messaging systems of the RBI and the CBUAE. This collaboration aims to streamline and expedite cross-border payments by enhancing the efficiency and security of the payment infrastructure. By integrating their respective systems, the RBI and CBUAE aim to enable seamless and cost-effective transfer of funds between India and the UAE. This step is particularly significant as it will simplify the payment process and reduce transaction costs for individuals and businesses engaged in bilateral trade and investment activities.

The agreements reflect the mutual commitment of both countries to strengthen their economic and financial ties. The framework for cross-border transactions in local currencies will not only facilitate smoother trade but also reduce the reliance on international currencies such as the US dollar. This move aligns with the broader global trend of promoting currency diversification and reducing exposure to exchange rate fluctuations.

Moreover, interlinking the payment and messaging systems will enhance the efficiency of cross-border transactions and support the growing digital economy. The integration of these systems will enable faster processing of payments, real-time fund transfers, and improved transparency in financial transactions. This will benefit individuals, businesses, and financial institutions operating between India and the UAE, fostering greater trust and confidence in cross-border transactions.

The agreements signed by the RBI and CBUAE reflect a broader trend of countries moving towards strengthening regional financial integration and reducing reliance on traditional global financial centers. By promoting the use of local currencies and interlinking payment systems, India and the UAE are taking significant steps to create a more interconnected and robust financial ecosystem within the region.

These agreements mark a significant milestone in the bilateral relationship between India and the UAE, showcasing their commitment to deepening economic cooperation and fostering financial stability. The establishment of a framework for cross-border transactions in local currencies and the interlinking of payment and messaging systems will not only enhance trade and investment but also contribute to the overall economic growth and development of both countries.