In a two-day meeting held under India’s Presidency, G20 finance ministers and central bank governors gathered to address pressing issues in international taxation and debt relief. The primary focus of the discussions was to devise strategies to overhaul global tax norms, ensuring multinational companies pay taxes wherever they operate, and to offer assistance to low and middle-income countries struggling with significant debt burdens.

One of the key topics under discussion was the need for multinational corporations to pay their fair share of taxes in the countries where they conduct business. Currently, some companies exploit loopholes in international tax regulations, enabling them to shift profits to low-tax jurisdictions, thus reducing their tax liabilities significantly. This practice, known as tax evasion, has serious implications for governments worldwide, leading to revenue losses and a lack of funds for public services and infrastructure development.

To tackle this issue, the G20 finance ministers proposed comprehensive measures to curb tax evasion. By implementing stricter regulations and enforcement mechanisms, they aim to ensure that multinational corporations are held accountable for their tax obligations in each country they operate in. The discussions also sought to create a level playing field for businesses, preventing unfair tax practices and promoting a more transparent and equitable global tax system.

In addition to addressing tax norms, the meeting also focused on providing relief to low and middle-income countries burdened with substantial debt. Many countries in these categories face challenges in servicing their debt obligations, impeding their economic growth and development prospects. As part of the discussions, the G20 explored potential solutions to ease these nations’ debt burden and promote sustainable growth.

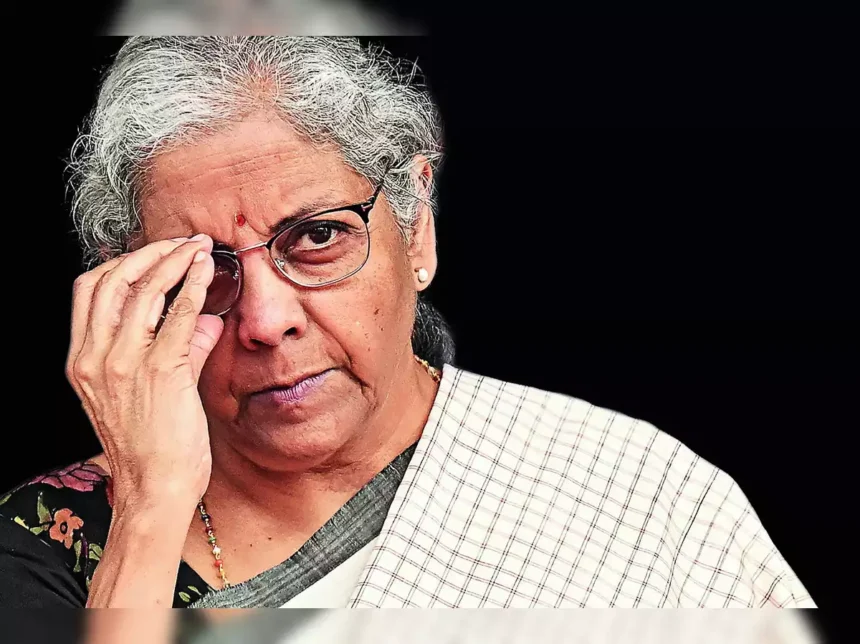

During the meeting chaired by Finance Minister Nirmala Sitharaman, participants exchanged views on the way forward in international taxation and the implementation of effective measures to combat tax evasion. Several countries shared their experiences and best practices in tackling tax-related issues, allowing others to learn from successful strategies and approaches.

The G20 finance ministers emphasized the importance of international cooperation in achieving these goals. Recognizing that tax evasion and debt crises are global challenges, they stressed the need for collaborative efforts among countries to foster a fair and inclusive financial system. By working together, countries can strengthen their regulatory frameworks, improve information sharing, and enhance capacity-building initiatives to combat tax evasion effectively.

Furthermore, the finance ministers acknowledged the importance of engaging with multinational corporations and other stakeholders to create a more inclusive and transparent tax regime. By involving businesses in the dialogue and decision-making process, they aim to foster greater compliance and a shared responsibility for a fair tax system that benefits societies worldwide.

As the meeting concluded, the G20 finance ministers and central bank governors expressed their commitment to taking concrete actions to implement the proposed strategies. They reaffirmed their dedication to supporting low and middle-income countries in their quest for debt relief and economic stability. The participants pledged to continue working together to address global challenges and create a sustainable and equitable financial environment for all nations.

The two-day G20 finance ministers and central bank governors meeting served as a crucial platform for discussing and proposing reforms in international taxation and debt relief. By prioritizing tax evasion prevention and debt assistance, the G20 aims to promote economic growth, stability, and prosperity for nations worldwide. Through international collaboration and consensus-building, the G20 seeks to usher in a new era of global tax norms that promote fairness, transparency, and cooperation among all stakeholders.