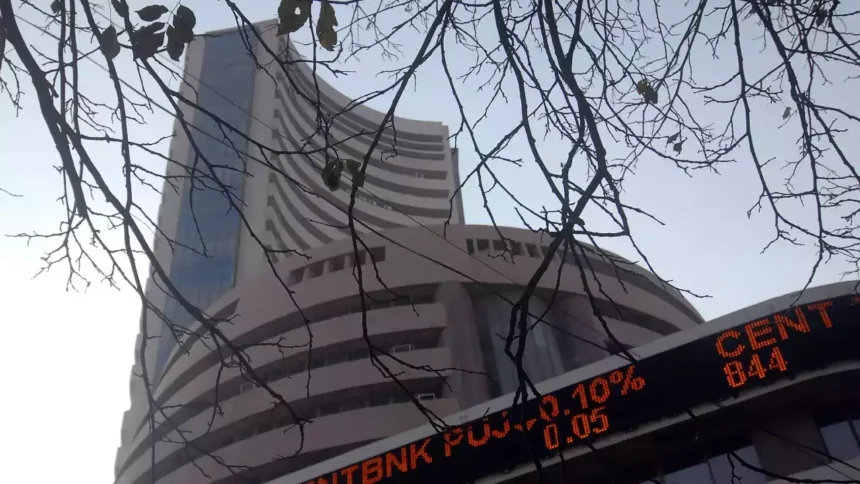

In a remarkable display of strength, benchmark equity indices reached their lifetime high levels on Wednesday, with the Sensex surging past the 64,000-mark and the Nifty scaling the 19,000 level during intra-day trade. This exceptional performance was driven by fresh foreign fund inflows and a rally in the US and European markets. Market heavyweight stocks like Reliance Industries and HDFC Bank also contributed to the positive momentum.

The 30-share BSE Sensex extended its rally from the previous day, gaining 499.39 points or 0.79 percent to settle at its lifetime closing high of 63,915.42 points. During the course of the day, the index soared 634.41 points or 1 percent, hitting its all-time intra-day peak of 64,050.44 points.

The surge in the equity markets can be attributed to several factors. First and foremost, fresh foreign fund inflows played a crucial role. International investors showed renewed interest in the Indian market, injecting significant capital. This influx of funds indicates confidence in the Indian economy’s growth prospects and its resilience in the face of global uncertainties.

Additionally, the rally in the US and European markets acted as a tailwind for Indian equities. Positive sentiment from these global markets spilled over into Indian stocks, boosting investor confidence and attracting further investment. The synchronized global recovery from the pandemic and improving economic indicators in major economies have bolstered optimism among investors worldwide.

Market participants were particularly buoyed by the strong performance of heavyweight stocks like Reliance Industries and HDFC Bank. These companies have a significant impact on the overall market sentiment due to their large market capitalization and widespread presence across sectors. The buying interest in these stocks added to the positive momentum, indicating investor confidence in their growth potential.

Reliance Industries, led by its visionary chairman Mukesh Ambani, has been at the forefront of technological innovation and diversification. The company’s robust performance across its various business verticals, including telecommunications, retail, and energy, has attracted investors. Moreover, the recent developments in the digital space, such as the company’s foray into e-commerce and the potential monetization of its digital assets, have further boosted investor sentiment.

HDFC Bank, one of India’s leading private sector banks, has consistently delivered strong financial results and maintained a solid reputation. The bank’s prudent lending practices, focus on customer service, and extensive branch network have positioned it as a preferred choice for investors. The bank’s consistent growth in loan disbursements, asset quality, and profitability has instilled confidence among shareholders and attracted buying interest.

The overall positive sentiment in the market can also be attributed to the Indian economy’s recovery from the impact of the COVID-19 pandemic. With vaccination programs underway and economic activities gradually resuming, the outlook for various sectors has improved. The easing of lockdown restrictions, coupled with government stimulus measures, has provided a boost to consumer spending and business sentiment.

However, it is essential to remain cautious and monitor the market dynamics closely. While the current market rally is driven by favorable factors, including foreign fund inflows and global market trends, the possibility of volatility and uncertainties cannot be overlooked. Factors such as geopolitical tensions, inflationary pressures, and policy changes can impact market performance. Therefore, investors should exercise prudence, diversify their portfolios, and consult financial experts to make informed investment decisions.

The benchmark equity indices in India achieved record-breaking highs, with the Sensex surpassing the 64,000-mark and the Nifty scaling the 19,000 level.